These are the questions everyone on Wall Street is trying to answer at every Fed meeting. The one this June was no different.

Basically what investors want to know is if the Fed is going to take its foot off the gas that has been pumping the stock market up for the past couple years.

If the Fed slows down its $85 billion a month money injection program, then investors are going to flee stocks like rats from the titanic, and the markets will sink almost as fast as that ill fated cruise.

This feared moment, may never arrive however.

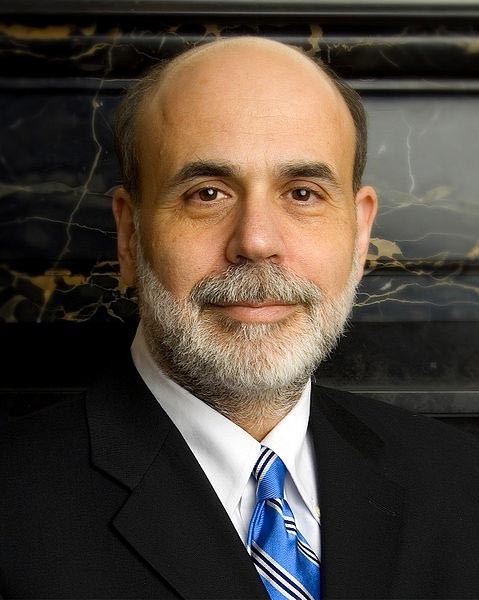

At least not while Bernanke is still at the helm, since doing so would put the economy into a tailspin and tarnish his cherished image of himself as a hero.

When this whole QE shenanigan began, it was going to be a one-time deal. But then came QE2, and then Operation Twist was going to be the last ditch effort, and so on.

It’s like Milton Friedman said, “There is nothing so permanent as a temporary Government program.”

The conversation used to be about an “exit strategy,” but now its limited to “when will tapering begin?”

It’s pretty clear that no matter what happens in the economy, the Fed has no idea how it is going to get the economy off of this cash addiction.

The economy has become like a drug addict, needing more and more cash to sustain itself. Making a return to true health is not going to be easy. It’s going to be very painful, and the longer this stimulus goes on the worse its going to be.

Bernanke knows this. And that’s why its going to keep going until 2014 when he retires.

Rather than focus on the long term, the Fed is simply trying to prevent a short term sell off on Wall Street, a spike in interest rates, or an end to the rebound in housing prices.

Bernanke won’t tolerate any of those outcomes, even though they are exactly what is needed to return the economy to true health. No pain no gain.

I expect we’ll continue to hear a lot more speculation about an exit strategy, but at the first sign of trouble the Fed will flinch, and throw a few more billion on the fire.

And after Bernanke leaves? Well, that’s not his problem is it…

Related Story: Tweedle-Dumb and Tweedle-Dumber